Ease your wish to close your EMI before tenure with below suggested ideas from shubhbank.com

Pre-Payment is not the only way to close your loan faster. To close the loans faster we can follow the 4 different methods.

Lets have a look on few reasonable tips in this context and detailed discussion hence forth for each ideology.

1. Increase your EMI

2. Make a part-payments

3. Loan as OD account product

4. Monitor you loans and correct to lower rates when ever possible.

Let me explain in detail of each of the method

1. Increase Your EMI :

This option to be used when you have more monthly savings and want to be debt free faster. Very important here is more monthly savings.Keep the sufficient buffer from your salary for living expenses and additional 10% as the buffer so that you don’t by increasing the EMI later day you don’t have tough time.

Increasing the EMI is much better option if you have steady flow of income and if you are planning to save some money and make a part-payment, then mathematically its better to increase the EMI. For example if you have to increase your EMI by Rs 5000 or saving Rs 5000 every month and after 12 months you make a saving of Rs 60,000/- and make a part-payment. Option 1 is better as it would contribute towards principle every month compare to after 1-year. You might be saving at-least extra Rs 2000 more.

One important thing to note is , most of the banks allow you to increase your EMI but very few allow you to decrease the EMI amount. So think before you do.

2. Make a Part-Payment :

This option to used when you have a lump sum amount received in the form on Bonus or when you have sold something and received the amount. Its said to keep things simple and stupid always clear your loans when ever you get a lump sum amounts.

One important thing to note is , each bank follows specific rule while receiving the part-payment. In case if you are walking to the branch mostly minimum part-payment should be 1 month EMI. If you are planning to pay via online it might be minimum 3-months EMI. Note each bank has its own policy, so please check.

3. Loan as OD account product:

This option can be used if you have availed a special loan product which provides OD facility. Let me explain what is OD Facility for the Loan. If you have availed a 50 Lac loan and say you have got 10 lac as bonus. Now if you transfer the 10 Lac to your Loan OD Account then Interest would be charged for only 40 Lac amount. Now after a 1-year, if you like to withdraw the 10 lac, then you can withdraw the amount as its parked. Then from that day what ever is the principle left, bank will be charging interest on the pending amount. What ever interest you have earned on 10 lac will be adjusted toward the principle. This allows to close the loan faster.

All banks don’t provide this products. Banks like Bank of Baroda, SBI , Standard Charted & IDBI have this option. These days banks are charging 0.10% to 0.20% more for this product. So avail them only if you are receiving a lump sum amount and want to use it later day or else make a part-payments to close the loan faster.

4. Monitor you loans and correct to lower rates when ever possible:

This option is least used but most powerful one with very little payment. When ever rates fluctuate one need to compare how his/her interest rate compare to ongoing market rate. In case if you are paying higher rate then ongoing we need to check are you going to really pay higher next change or not before correcting.

Interest rate has two components,

Interest Rate = MCLR(Base Rate) + Margins

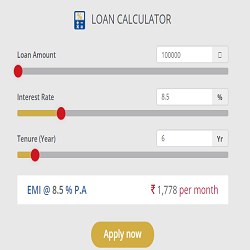

When you avail your loan in variable rate, the margin gets fixed. So say you availed a loan at 8.50% where in MCLR is 8.00% and Margin is 0.50%

Interest rate = 8.50% = 8.00% + 0.50%

Next change if MCLR(Base rate) changes to 9.00% then your rate would be 9.50%

if it become if MCLR(Base rate) changes to 7.00% then your rate would be 7.50%

Now suppose, if you are paying 9.50% at a given time and in the market if the new customer is getting at 9.25% then we have to check why is he paying 9.25%.

There can be 2 cases .

1. He is paying lower margin then you. Say MCLR(Base Rate) is at 9.00% and his Margins are only 0.25% then its a time to correct your margins from 0.50% to 0.25%

2. He is paying higher margin then you. Yes its possible if the MCLR(Base Rate ) is at 8.50% and Margins are at 0.75% then he would still pay 9.25% 0.25% less than you for 1-year. But later after 1-year if the MCLR(Base Rate) changes to 10% then you would be paying 10.50% where as this person is going to pay 10.75%.