Tag: apply for loan

Have you achieved your financial goals before the New Year knocks at your door? Everyone is gearing up to welcome the New Year with pomp and splendor, we would suggest you to spare some time to assess the year gone by, especially in terms of finances. It is not a difficult task as we are always there to help you get head start. Here we are presenting some financial moves that you must take, if you want to be financially sorted for the coming year.

Status of your financial goals: Have you charted out how far have you reached in terms of achieving the financial goals? We understand that some of your goals are long term, hence, would take long time to achieve but what about your short term goals? It is high time to review the status of your goals. It will help you to figure out what’s been working or what’s not. Moreover, this outlines can help you priorities your goals or set the new ones for the coming year.

Revise your budget: If you don’t have your budget in place, it is better to start working on where you have been spending and if your priorities are in place or not. You can also re-outlay your budget for the New Year to maximize savings.

Make a strategy to pay-off after evaluating your debts: Your financial health can be affected by too many debts. So what’s situation you are in, how much loan do you have to repay and credit card dues you have? Ask yourself about unnecessary and unexplained expenses that can be cut down. It’s time to take complete control of your finances, cut down on expenses and dedicate your income towards clearing debts and savings. If your credit report is messed up, get focused on repairing it as it is important for your financial future.

Re-balance your financial portfolio: You have to invest somewhere to face the emergency situations in life. It is must to re-balance your finances at least once a year and the end of the year is the best time to do so. You must re-balance your portfolio only if your financial objectives have not changed otherwise you may consider changing your asset allocation. Re-balancing gets your investment portfolio back to its original state.

Review your insurance policy: Change is the way of life. Getting an adequate “Insurance Policy“ can help you tide through unpredictable life and uncertainties thrown by it. It is advisable to review your insurance plans at least once a year to accommodate any changes. Changes may include from getting married/divorced to having a child to buying your dream house. As the magnitude of the change increases, you may consider increasing your insurance cover.

ShubhBank have got your back when it comes to financial assistance. Just click ShubhBank.com to start exploring whether you want to start your own business, to plan a long international holiday or invest in something that interests you.

These days, it is always significant for the bank or lender to be aware of how a borrower will repay the loan when it comes to Personal Loan. If you have been maintaining a good credit history by paying all the dues on time then it will increase your credibility as a borrower and boost your chances of loan approval. There are some other steps also that one can take into account to accelerate the loan approval. Here are the tested ways how to get instant approval on your “Personal Loan“ application mentioned below:

Meet the eligibility criteria: It is advisable to compare the eligibility requirements of different lenders before applying for a loan. Most of the lenders have a minimum age requirement of 21 years and maximum of 60 years. Moreover, banks also have different age requirements for salaried and self-employed individuals. The employment area and income criteria also vary from lender to lender. Make sure to meet all the requirements for a speedy approval.

Keep documentation handy: The main documents you will need to have are identity proof, age proof, address proof and income documents. These may include a Voter ID card, PAN card, Aadhaar card, driving license or utility bills such as electricity, phone or gas bill can serve this. Income documents comprises of three month pay slips and bank statement.

Do not skip the research: One of major setback in rejection is avoiding the enough research. Every lender offers different interest rate. Consider all the options, do not go with the first lender, you could miss out on better loan offers from other lender. Do check upon the processing fees and other applicable charges too. Compare all these factors before finalizing the loan.

Be careful about credit history: At the last but not least, lenders will definitely want to scrutinize your credit report. If your CIBIL score is anywhere less than the expected or if you have defaulted payments on your existing loans, it will decrease your chances to “Get a Quick Approval On Your Personal Loan“ request. It is always good maintain your finances in order. There are several platforms available on the internet where you can check your Credit Score for free. Make sure to review your report before opting for a loan, if there are any inaccuracies or errors, so they can be fixed on time.

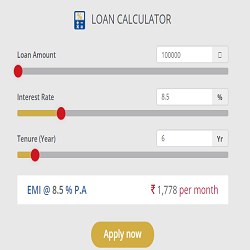

It is suggested to look upon the loan amount requirement, whether you are borrowing for the long term or short term, always remember to borrow according to your repayment capability. It should be a wise decision to secure that much quantum which could be paid off easily. It is good to repay the borrowed amount without having to get into more debt. The equated monthly installment of your borrowed credit should not exceed 50% of your monthly income. Taking such pointers into consideration, you’re sure to speed up your loan processing. To explore exclusive deals on financial products, just click on ShubhBank.com.

A personal loan is mainly a type of loan that is unsecured and helps you to cover up your current economic necessities. You don’t need to vow any collateral security while to have a personal loan, and your lender makes you flexible to utilise the funds as you need. It can fulfil your dreams to manage your trip costs and marriage expenditures or any medical crisis, residential renovation, debt consolidation and others.

Eligibility To Get A Personal Loan-

It is the time to fulfil your fantasies into reality with a Personal Loan. You can now use the EMI Calculator of Personal Loan to calculate your monthly spending way before you will apply for a loan and have a detailed conclusion of your monthly expenses well in advance if you are a salaried person.

“Personal Loan For Salaried:“

Individuals can take a Personal Loan:

● The person should be a Salaried Employee.

● Salaried doctor

● Municipal and private limited companies employees.

● Employees including government and Public Sector that Undertakings,

The criteria are-

● The minimum age will be 21 years

● Maximum period will be 60 years (maturity time of the Personal Loan)

● The person’s minimum net monthly income will be Rs. 15,000

How to apply for a personal loan

If you’re curious in leasing a personal loan, but confused “How to Get a Personal Loan“ Here the ways-

1. At first, check your credit score.

A credit score is a crucial component to qualify for an unsecured personal loan. Lenders don’t divulge what the rating they are looking for is; but of course, they mostly prefer outstanding or excellent credit.

2. Secondly, do order a manuscript of the credit report.

Your credit score denotes your creditworthiness; it doesn’t exhibit you the full impression. To know more in detail, order an available manuscript of your credit summary.

You can also get a free report once 365 days from these 3 credit bureaus: Equifax, TransUnion and Experian. It will indicate any outstanding obligation, along with your past of reimbursement and other factors that can affect your credit score.

3. Thirdly you need to pay your bills on time.

If your credit score is terrible, you can try to improve it by soon bill payment.

4. Fourthly, pay down your debt.

Your debt to your income ratio is another main factor may affect your credit score. If you got a high rate, pay your mortgage could help increase your score.

5. You need to submit a joint petition with a creditworthy cosigner.

The essential documents needed for a personal loan-

These are the documents that are expected on with Loan application:

● (Identity proof) One copy of passport or voter ID card or driving license or Aadhaar card

● (Address proof) 1copy of passport or voter ID card or driving license or Aadhaar card

● Your Bank statement of the recent three months as, Passbook of the previous six months

● Your latest salary slip with current dated salary receipt with most current Form 16 is required.

You might be in your late 40’s and you are working twice as hard to get half the reward to lead a comfortable life and you might be forgetting something very important to your future. After some years when you retire, there will not be any cushion to protect your backbone as you will not be drawing the salary that time. You need to lay out a plan that your life after retirement will be as pleasant as now. Retirement is an important event in one’s life as it marks the end of one phase. It is necessary to be financially fit at that age but for achieving this, you need to plan carefully to lead a good life. In this article, we are going to discuss what the importance of “Future Financial Planning In Life“ is and why you should secure your future early.

REASONS FOR SECURING YOUR FUTURE EARLY IN LIFE

You might be wondering what it is required to plan so early in your life. There are some reasons mentioned below that why should you start planning immediately.

Quality of Life: If you are really planning to lead the life as you are leading now such as with your maximum salary, then you have to start planning early to maintain the same quality of life. The long term plan will enable you to save significantly. On a flip side, you will have to scrimp after your retirement and finances will become more of a restriction.

Income: You may have the income sources in future like pension, side business, rent etc. but you will most likely have a little income. It is good to start a calculation now and try to save up from now for a better future.

Medical Expenses: Aging is sure to bring along some diseases and illness. As per saying, “Man is not immortal.” Now you might be fit as fiddle but after a certain age, your health starts deteriorating and there may be some medical expenses. If you are aware of such things then you should save up now to afford your medical expenses after retirement.

Other Expenses: In coming years, you might want to fund your grandchildren’s higher studies or their wedding; with this view you should probably start saving up immediately. On contrary, you have to liquidate some assets to fulfill these requirements, ultimately leading to the bad quality of life.

Moreover, life is always unpredictable. You might plan something and life may have something totally different in store for you. You should be prepared for unforeseen events such as medical emergency or any other financial need. If you have saved up a substantial amount of money for future, you can use it in dire consequences as well. Saving up early in life is always advantageous because your earnings have more time to compound and grow. So planning for your future is more like an ongoing process which pays off after your retirement.

Ease your wish to close your EMI before tenure with below suggested ideas from shubhbank.com

Pre-Payment is not the only way to close your loan faster. To close the loans faster we can follow the 4 different methods.

Lets have a look on few reasonable tips in this context and detailed discussion hence forth for each ideology.

1. Increase your EMI

2. Make a part-payments

3. Loan as OD account product

4. Monitor you loans and correct to lower rates when ever possible.

Let me explain in detail of each of the method

1. Increase Your EMI :

This option to be used when you have more monthly savings and want to be debt free faster. Very important here is more monthly savings.Keep the sufficient buffer from your salary for living expenses and additional 10% as the buffer so that you don’t by increasing the EMI later day you don’t have tough time.

Increasing the EMI is much better option if you have steady flow of income and if you are planning to save some money and make a part-payment, then mathematically its better to increase the EMI. For example if you have to increase your EMI by Rs 5000 or saving Rs 5000 every month and after 12 months you make a saving of Rs 60,000/- and make a part-payment. Option 1 is better as it would contribute towards principle every month compare to after 1-year. You might be saving at-least extra Rs 2000 more.

One important thing to note is , most of the banks allow you to increase your EMI but very few allow you to decrease the EMI amount. So think before you do.

2. Make a Part-Payment :

This option to used when you have a lump sum amount received in the form on Bonus or when you have sold something and received the amount. Its said to keep things simple and stupid always clear your loans when ever you get a lump sum amounts.

One important thing to note is , each bank follows specific rule while receiving the part-payment. In case if you are walking to the branch mostly minimum part-payment should be 1 month EMI. If you are planning to pay via online it might be minimum 3-months EMI. Note each bank has its own policy, so please check.

3. Loan as OD account product:

This option can be used if you have availed a special loan product which provides OD facility. Let me explain what is OD Facility for the Loan. If you have availed a 50 Lac loan and say you have got 10 lac as bonus. Now if you transfer the 10 Lac to your Loan OD Account then Interest would be charged for only 40 Lac amount. Now after a 1-year, if you like to withdraw the 10 lac, then you can withdraw the amount as its parked. Then from that day what ever is the principle left, bank will be charging interest on the pending amount. What ever interest you have earned on 10 lac will be adjusted toward the principle. This allows to close the loan faster.

All banks don’t provide this products. Banks like Bank of Baroda, SBI , Standard Charted & IDBI have this option. These days banks are charging 0.10% to 0.20% more for this product. So avail them only if you are receiving a lump sum amount and want to use it later day or else make a part-payments to close the loan faster.

4. Monitor you loans and correct to lower rates when ever possible:

This option is least used but most powerful one with very little payment. When ever rates fluctuate one need to compare how his/her interest rate compare to ongoing market rate. In case if you are paying higher rate then ongoing we need to check are you going to really pay higher next change or not before correcting.

Interest rate has two components,

Interest Rate = MCLR(Base Rate) + Margins

When you avail your loan in variable rate, the margin gets fixed. So say you availed a loan at 8.50% where in MCLR is 8.00% and Margin is 0.50%

Interest rate = 8.50% = 8.00% + 0.50%

Next change if MCLR(Base rate) changes to 9.00% then your rate would be 9.50%

if it become if MCLR(Base rate) changes to 7.00% then your rate would be 7.50%

Now suppose, if you are paying 9.50% at a given time and in the market if the new customer is getting at 9.25% then we have to check why is he paying 9.25%.

There can be 2 cases .

1. He is paying lower margin then you. Say MCLR(Base Rate) is at 9.00% and his Margins are only 0.25% then its a time to correct your margins from 0.50% to 0.25%

2. He is paying higher margin then you. Yes its possible if the MCLR(Base Rate ) is at 8.50% and Margins are at 0.75% then he would still pay 9.25% 0.25% less than you for 1-year. But later after 1-year if the MCLR(Base Rate) changes to 10% then you would be paying 10.50% where as this person is going to pay 10.75%.

As per the recent trends it is wrong to look only at the interest rate. There are many factors that should be taken into consideration when applying for a loan. If you make your comparison on the basis of the interest rate then most probably you will make a mistake.

If you have to choose between offers from two different banks, one offering a loan with 9% interest and the other with 10.5% interest, which bank will you apply for. According to your question you would go for the loan with 9% interest. But the problem is that, the lower interest rate loan might actually have a lot of hidden fees. So, at the end, what seems to be a cheaper loan would eventually turn out to be more expensive one.

Next, what type of loan are you looking for. If you are looking for a unsecured loan, then you should know that this type of loan bears a higher interest compared to secured loan. On the other hand, if you have collateral, you can “Apply For a Secured Loan” and thus negotiate a better deal on your interest. See the all types of loans are offered by banks.

Moreover, before making any decision about taking a loan, make sure that you define the characteristics of the best loan for. What is the best for me, doesn’t necessary means that is the best for you. Do analyze that the best loan in market is suitable for you or not. Make sure that you define a general criteria so you could evaluate different offers.

As far as best bank is concerned, one should look at newly established banks, or banks that have a strategic goal to expand their client base. These banks most often have promotional offers, where you could be able to obtain a loan with better terms.

At the end, if you are only concerned about the financial part of the loan, look at the full cost of the loan, and then make adequate comparison. What you opt is what you will have to pay at the end so lucrative offers also have to be accessed on the aspects of long term need or short term requirement. If going for a long term loan more than 5 years then also consider the amortization schedule as it leads to higher rate of interest and short term loans are though cheaper yet the burden remains heavy till the time one square off the entire debt . Better way Is to compare the banks and other lending institutions as per your necessity and eligibility. Eligibility plays important factor as because of banks internal eligiblity policy you may miss the attractive offers too. Hence aspire for the best to grow but be cautious to play the terms variably so as not to get caught in the Bank in morality of high indebtedness.